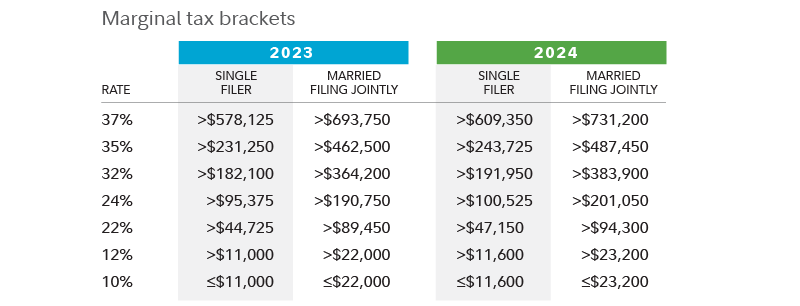

ca 2024 tax brackets instructions – How do tax brackets work? A single person with $140,000 in taxable income in 2024 would be in the 24% tax bracket. This doesn’t mean all of their income is taxed at that rate. Their effective . Flipping the calendar from 2023 to 2024 will bring important changes online questionnaire for determining eligibility. Tax brackets are income ranges for which a particular tax rate applies. .

ca 2024 tax brackets instructions

Source : www.healthforcalifornia.com

Your First Look At 2024 Tax Rates: Projected Brackets, Standard

Source : www.forbes.com

IRS New Tax Brackets 2024 ~ When Will New Tax Brackets for Year

Source : interbseb.com

2024 Tax Brackets: IRS Reveals New Income Thresholds | Money

Source : money.com

Your First Look At 2024 Tax Rates: Projected Brackets, Standard

Source : www.forbes.com

Health Insurance Income Limits 2024 to receive CoveredCA subsidy

Source : insurancecenterhelpline.com

Federal Tax Income Brackets For 2023 And 2024

Source : thecollegeinvestor.com

2023 State Income Tax Rates and Brackets | Tax Foundation

Source : taxfoundation.org

Capital Gains Tax Brackets For 2023 And 2024

Source : thecollegeinvestor.com

Tax brackets 2024| Planning for tax cuts | Fidelity

Source : www.fidelity.com

ca 2024 tax brackets instructions Covered California Income Limits | Health for California: (Darryl Dyck/The Canadian Press) New tax measures, and changes to existing ones, will begin affecting Canadians in 2024. But tax experts federal income tax bracket thresholds in Canada . The Internal Revenue Service (IRS) has unveiled its annual inflation adjustments for the 2024 tax year, featuring a slight uptick in income thresholds for each bracket compared to 2023. .

-1fdab78.png)