ca 2024 tax brackets 2020 – For 2024, the standard tax deduction for single filers has been raised to $14,600, a $750 increase from 2023. For those married and filing jointly, the standard deduction has been raised to $29,200, . How do tax brackets work? A single person with $140,000 in taxable income in 2024 would be in the 24% tax bracket. This doesn’t mean all of their income is taxed at that rate. Their effective .

ca 2024 tax brackets 2020

Source : twitter.com

2023 State Income Tax Rates and Brackets | Tax Foundation

Source : taxfoundation.org

Shehan on X: “2024 tax brackets https://t.co/mNQ6cbFAka” / X

Source : mobile.twitter.com

Federal Tax Income Brackets For 2023 And 2024

Source : thecollegeinvestor.com

California Income Tax 2023 2024: Rates, Who Pays NerdWallet

Source : www.nerdwallet.com

2023 2024 Tax Brackets and Federal Income Tax Rates | Bankrate

Source : www.bankrate.com

2023 2024 Tax Brackets & Federal Income Tax Rates – Forbes Advisor

Source : www.forbes.com

Brendon Pierce, CIMA®, CEPA® Chicago Oakbrook Financial Group

Source : www.linkedin.com

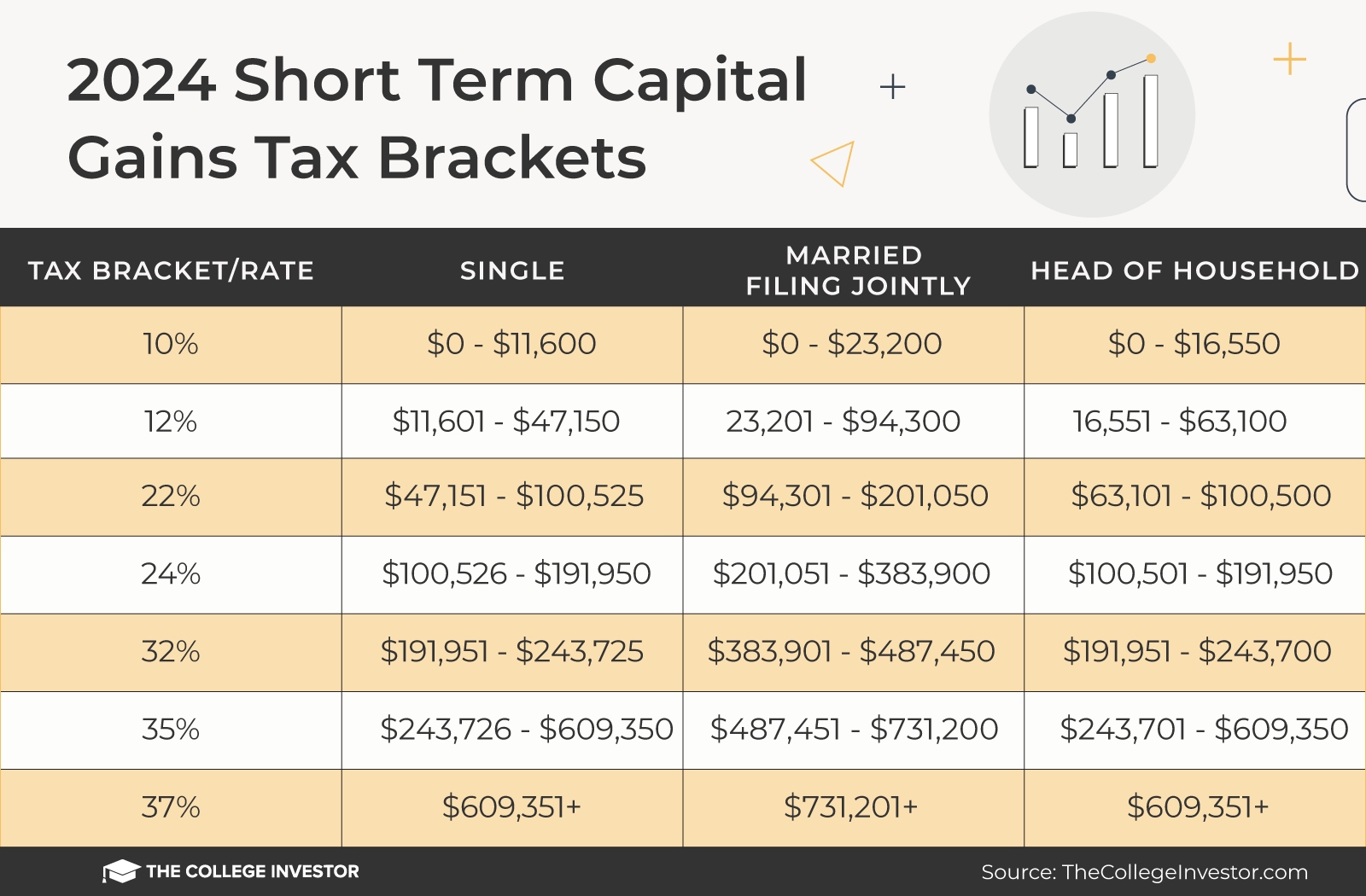

Capital Gains Tax Brackets For 2023 And 2024

Source : thecollegeinvestor.com

2023 2024 Taxes: Federal Income Tax Brackets and Rates

Source : www.debt.org

ca 2024 tax brackets 2020 Tax Foundation on X: “The IRS released its inflation adjusted tax : The IRS will start accepting your 2023 tax returns as soon as Jan. 29, and changes this year could mean a little extra money in your pocket. . Long-term capital gains tax is applied to investments that have been held for over a year before they were sold for a profit. Long-term capital gains are generally taxed at a lower rate. For the 2024 .